- 05.04.2023

- News

Tobacco industry uses six pricing strategies to undermine life-saving tobacco taxes

New STOP report provides a compelling overview summary of the six tobacco industry pricing strategies that undermine life-saving tobacco taxes.

STOP, the global tobacco industry watchdog at the University of Bath has produced a new report titled "The Price We Pay: Six Industry Pricing Strategies That Undermine Life-Saving Tobacco Taxes” The report highlights the significant impact that tobacco use has on global health and the global economy and estimates that the global economic cost of tobacco use is more than $1 trillion annually, due to factors such as healthcare costs, lost productivity, and premature death. The authors note that tobacco use exacerbates poverty and inequality, as it disproportionately affects marginalized populations and contributes to a range of health and economic disparities.

Tax and price policies, as described in Article 6 of the WHO Framework Convention on Tobacco Control (WHO FCTC), are one often the measures effective at reducing tobacco use, as well as generating government revenue.

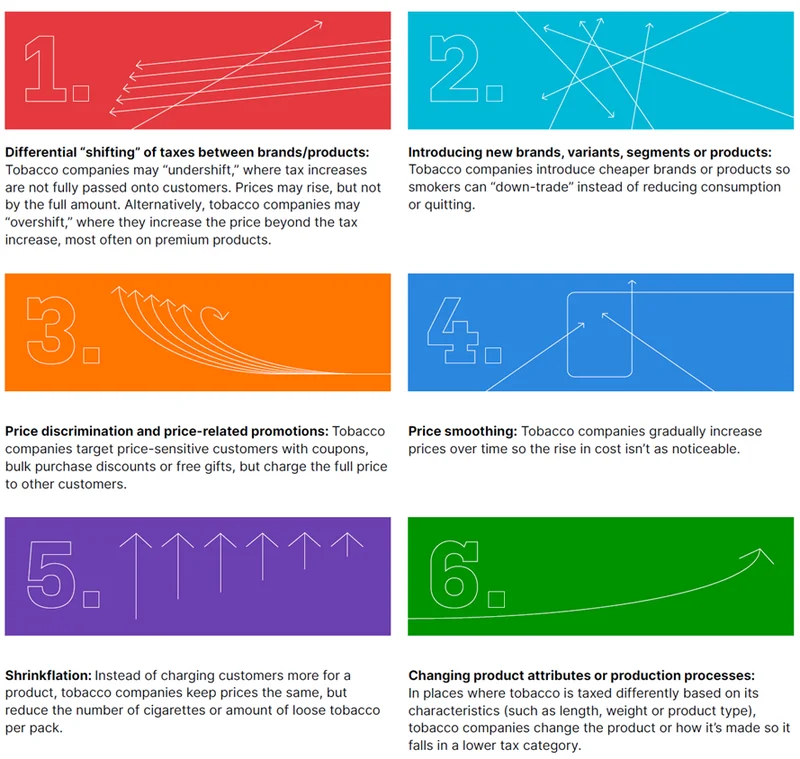

The engaging STOP report explores the tobacco industry’s response to increases in tobacco taxes, examining the pricing strategies employed to undermine the effects of higher taxes. By drawing on recent academic studies, the authors describe six pricing strategies used by tobacco companies:

Source: STOP

The discussion on each industry strategy describes the tactic in detail, the consequences of the strategy and provides real-world illustrations of its use with one or more country examples. They also provide country/region-specific case studies to offer in-depth illustrations of the issues. The report concludes with policy recommendations and highlights the need to gather more empirical evidence on the tobacco industry’s actions in response to planned tobacco tax increases in order to formulate effective responses.

Tobacco and Poverty

Nicotine addiction and tobacco consumption has a disproportionate burden on people with the lowest incomes, with rising costs of living, the return of inflation combined with a lack of resources and a higher prevalence of daily smoking. A new campaign by the Alliance Against Tobacco in France addresses this issue.[i]

Generally, tobacco use makes poor people poorer.[ii] Increasing tobacco taxes reduces the disproportionate burden that tobacco imposes on the poor.[iii] It has been demonstrated that excise tax increase policies do not have an adverse effect on low-income households; on the contrary, they lower their cigarettes expenditure and their tax burden, while lower cigarettes consumption has an additional, positive effect on their health, which attenuates future inequalities.[iv]

Tobacco Taxation in Switzerland

Tobacco taxation in Switzerland has been described as weak because the country has some of the lowest tobacco taxes in Europe. Currently, the tax on tobacco products in Switzerland is significantly lower than the average tobacco tax in the European Union. While the World Health Organisation (WHO) recommends a tax rate of at least 75%, the tax rate in Switzerland is around 60%. Overall, the weak nature of tobacco taxation in Switzerland has been a concern for public health advocates, as it has made it more difficult to reduce tobacco use and its associated health risks. Soon, the Swiss Parliament will deal with the partial revision of the Tobacco Tax Act, with E-cigarettes now to be taxed for youth protection reasons. Unfortunately, however, the Federal Council does not have the courage for a comprehensive revision and refrains from a proposal for a comprehensive increase of the tobacco tax for all tobacco products.

Read the full STOP report here:

Read the summary here:

[i] https://alliancecontreletabac.org/2023/01/08/pouvoir-de-vivre/

[ii] Efroymson, Debra; FitzGerald, Sian; Jones, Lori (2011): Tobacco and Poverty: Research for Advocacy Guidelines. HealthBridge Foundation of Canada. Ottawa. Available online at https://healthbridge.ca/images/uploads/library/TobaccoPovertyResearchGuidelines_English.pdf.

[iii] Chaloupka, F. J.; Blecher, E. (2018): Tobacco & Poverty. Tobacco Use Makes the Poor Poorer; Tobacco Tax Increases Can Change That. Policy Brief. Tobacconomics, Health Policy. Chicago.

[iv] Vladisavljevi?, Marko; Zubovi?, Jovan; ?uki?, Mihajlo; Jovanovi?, Olivera (2021): Inequality-Reducing Effects of Tobacco Tax Increase: Accounting for Behavioral Response of Low-, Middle-, and High-Income Households in Serbia. In International journal of environmental research and public health 18 (18). DOI: 10.3390/ijerph18189494.